In the world of finance and business, bookkeeping is one of the most fundamental functions. It forms the bedrock upon which sound financial management is built. Whether you’re a freelancer, managing bookkeeping for small business, or an aspiring accountant, understanding bookkeeping is essential for maintaining financial health and compliance.

Table of Contents

What is Bookkeeping?

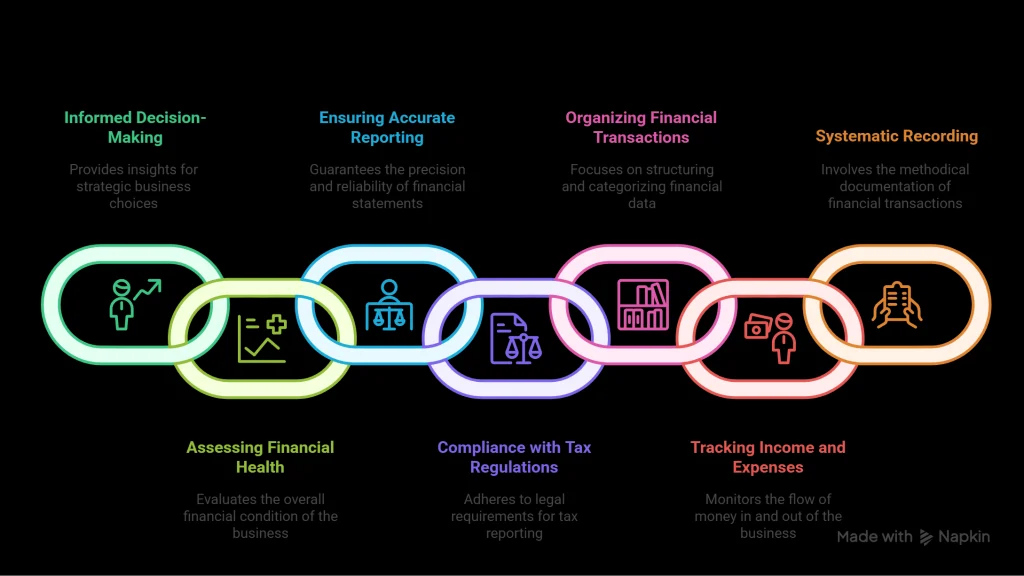

Bookkeeping is the systematic recording, organising, and storing of financial transactions for a business or individual. It ensures that every financial activity—from a simple sale to a complex expense—is accurately documented and easily accessible.

Unlike broader accounting, which involves analysing and interpreting data, bookkeeping focuses on the accurate, timely recording of transactions. It’s the first step in the accounting process and crucial for producing reliable financial statements.

Why is Bookkeeping Important?

Bookkeeping serves several critical purposes, including:

Financial Accuracy

Maintaining accurate records helps businesses understand their financial position and make informed decisions.

Legal Compliance

Governments and tax authorities require accurate records. Bookkeeping ensures you meet obligations and avoid penalties.

Cash Flow Management

Tracking income and expenses helps you manage cash flow more effectively, preventing overdrafts and missed payments.

Preparation for Audits and Reports

Well-kept books simplify the process of producing financial reports or undergoing an audit, whether internal or external.

Supporting Growth

When financial data is up-to-date, it’s easier to plan for expansion, apply for loans, or attract investors.

Types of Bookkeeping Systems

There are two main methods of bookkeeping, and choosing the right one depends on the size and complexity of your business.

Single-Entry Bookkeeping

- Simpler method, suitable for small businesses.

- Records one entry per transaction (e.g., cash in or cash out).

- Good for tracking cash flow but limited in detail.

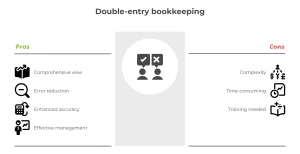

Double-Entry Bookkeeping

- Each transaction is recorded in at least two accounts: debit and credit.

- Provides a more comprehensive view of financial health.

- Essential for larger businesses and required by most accounting standards.

Key Bookkeeping Tasks

Bookkeepers perform a wide range of tasks to maintain the financial integrity of a business:

Recording Financial Transactions

All business activities like sales, purchases, payments, and receipts are recorded in journals or software.

Managing Invoices and Receipts

Keeping track of money owed and received ensures timely payments and better cash flow.

Reconciling Bank Statements

This involves comparing records to actual bank statements to detect errors or fraud.

Maintaining the General Ledger

The general ledger is the main book where all transactions are categorised and summarised.

Payroll Processing

Bookkeepers often handle salary payments, tax deductions, and employee benefits.

Bookkeeping vs. Accounting: What’s the Difference?

While often used interchangeably, bookkeeping and accounting are distinct roles:

Feature | Bookkeeping | Accounting |

Focus | Recording transactions | Analysing and interpreting data |

Output | Journals, ledgers, financial entries | Financial statements, forecasts |

Role | Operational | Strategic |

Skill Level | Foundation-level | Requires more training or certification |

Bookkeeping lays the groundwork for the accountant’s analysis and reporting.

Tools and Software for Bookkeeping

Modern bookkeeping is streamlined through technology, reducing human error and improving efficiency. Popular tools include:

- QuickBooks – A leading option for small to medium-sized businesses.

- Xero – Cloud-based software with real-time data access.

- FreshBooks – Great for freelancers and service-based businesses.

- Sage – Ideal for UK-based businesses seeking scalable solutions.

These platforms automate many tasks, such as invoicing, expense tracking, and reporting, freeing up time and improving accuracy.

Common Bookkeeping Terms

To navigate bookkeeping effectively, it’s helpful to understand key terms:

Assets – Items of value owned by the business (e.g., cash, inventory, equipment).

Liabilities – Debts or obligations (e.g., loans, accounts payable).

Equity – Owner’s interest in the business after liabilities.

Revenue – Income from sales or services.

Expenses – Costs incurred in running the business.

Hiring a Bookkeeper vs. DIY Bookkeeping

Deciding whether to manage bookkeeping yourself or hire a professional depends on your business size, complexity, and budget.

When to DIY:

You’re just starting and have minimal transactions.

You’re familiar with bookkeeping basics.

You use simple software that automates most tasks.

When to Hire a Bookkeeper:

Your transactions are increasing and becoming complex.

You’re spending too much time on financial admin.

You need reliable, compliant reports for investors or tax purposes.

Benefits of Good Bookkeeping

A robust bookkeeping system contributes significantly to business success by:

Reducing financial errors

Helping secure funding

Supporting tax planning

Enhancing transparency and accountability

Promoting long-term financial stability

Conclusion

Bookkeeping may seem like a behind-the-scenes task, but it’s vital for any successful business. Accurate and timely financial records not only keep your operations compliant but also empower better decision-making. Whether you’re doing it yourself or hiring help, a solid bookkeeping process will set your business up for long-term success.

Other Related Readings

What Is Accounting? A Beginner’s Guide to Financial Basics

What is Financial Accounting? A Clear Guide for Beginners

What is Managerial Accounting? A Practical Guide for Business Decision-Making

What is Cost Accounting? Understanding Costs to Boost Profitability

What is Tax Accounting? A Practical Guide for Businesses and Individuals

What is Tax Accounting? A Guide to Managing Taxes Effectively

What is Public Accounting? Services, Roles, and Career Insights

What is Private (Corporate) Accounting? A Guide for Businesses and Aspiring Accountants