In a competitive business environment, managing costs effectively can mean the difference between thriving and merely surviving. That’s where cost accounting comes in. It provides businesses with detailed insights into the costs associated with producing goods or delivering services—enabling smarter decisions, accurate pricing, and better profitability.

Whether you’re a small business owner, finance student, or aspiring accountant, this guide will give you a clear understanding of cost accounting and why it matters.

Table of Contents

What is Cost Accounting?

Cost accounting is a specialised branch of accounting that focuses on capturing, analysing, and controlling the costs associated with business activities. It aims to determine how much it costs to produce a product, provide a service, or run an operation.

Unlike financial accounting, which is designed for external stakeholders, cost accounting is primarily used for internal decision-making. It helps businesses set prices, plan budgets, reduce waste, and maximise efficiency.

Objectives of Cost Accounting

The main objectives of cost accounting include:

Cost Control: Identify and reduce unnecessary expenses.

Cost Planning: Estimate future costs for budgeting and forecasting.

Profitability Analysis: Understand the profitability of different products, services, or departments.

Operational Efficiency: Analyse production costs and resource usage to improve processes.

Pricing Decisions: Provide accurate cost data to set competitive and profitable prices.

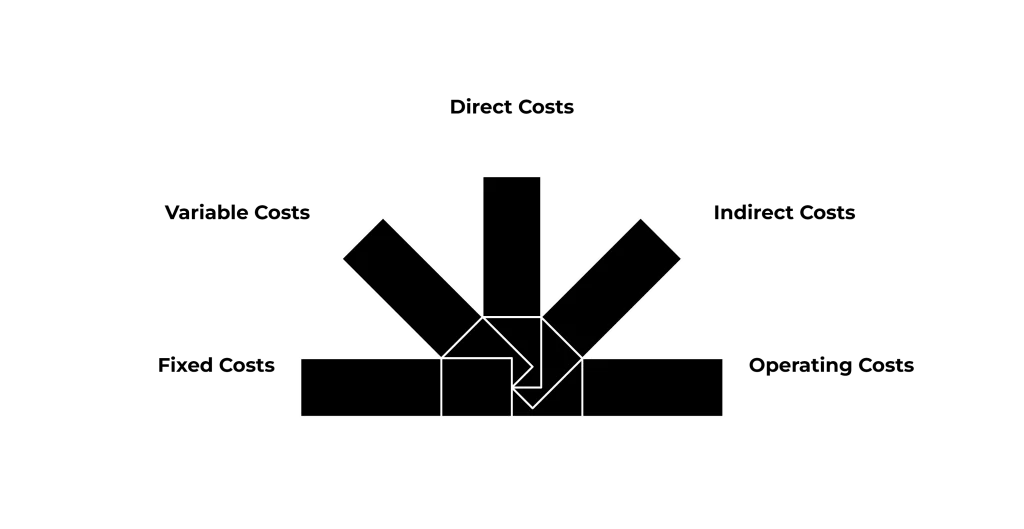

Types of Costs in Cost Accounting

Understanding different types of costs is essential in cost accounting:

1. Fixed Costs

Costs that remain unchanged regardless of production levels (e.g., rent, salaries).

2. Variable Costs

Costs that vary directly with production volume (e.g., raw materials, packaging).

3. Direct Costs

Expenses that can be directly traced to a product or service (e.g., labour, materials).

4. Indirect Costs (Overheads)

Costs that are shared across products or services (e.g., utilities, maintenance).

5. Operating Costs

Daily costs involved in running the business, both fixed and variable.

Methods of Cost Accounting

Several methods are used depending on the type and scale of a business:

Job Costing

Used when products are made to order. Each job is treated as a unique cost unit (e.g., construction projects, custom furniture).

Process Costing

Used for mass production of similar items. Costs are averaged over all units (e.g., food manufacturing, paint production).

Activity-Based Costing (ABC)

Allocates overheads more precisely by identifying cost-driving activities (e.g., machine hours, customer service time).

Standard Costing

Uses predetermined costs for materials, labour, and overheads. Actual results are compared to these standards to find variances.

Marginal Costing

Focuses on the cost of producing one additional unit. Useful for short-term pricing and decision-making.

Cost Accounting vs Financial Accounting

Though both deal with financial information, they serve different purposes:

| Feature | Cost Accounting | Financial Accounting |

| Purpose | Internal decision-making | External reporting |

| Focus | Costs of production and operations | Financial position and performance |

| Flexibility | Customised and detailed | Standardised and regulated |

| Reporting Frequency | As needed | Periodic (quarterly, annually) |

Functions of Cost Accounting

Cost Allocation

Assign costs to different departments, products, or services.

Cost Control

Monitor expenses against budgets and take corrective action when needed.

Inventory Valuation

Determine the value of stock based on production costs.

Budgeting

Support the creation of operating and capital budgets with accurate cost estimates.

Profit Planning

Analyse margins and contribution to decide which products or services are most profitable.

Benefits of Cost Accounting

Improved Cost Management: Helps identify waste and inefficiencies.

Better Pricing Strategies: Ensures pricing reflects true costs.

Enhanced Profitability: Supports decisions that increase margin.

Strategic Resource Allocation: Guides where to invest time, money, and labour.

Supports Business Growth: Informs scaling, expansion, or streamlining decisions.

Modern Tools in Cost Accounting

Cost accounting has evolved with technology. Today, businesses use tools such as:

ERP Systems (e.g., SAP, Oracle) – Integrate cost data across departments.

Cloud Accounting Software (e.g., Xero, QuickBooks) – Offer real-time cost tracking.

Spreadsheets and Custom Dashboards – Used for cost modelling and forecasting.

Business Intelligence Tools – Visualise trends and performance for better analysis.

Cost Accountant’s Role

A cost accountant is responsible for:

Gathering and analysing cost data

Creating cost reports and budgets

Advising on cost-saving strategies

Coordinating with production and operations teams

Ensuring compliance with internal controls

Essential skills include attention to detail, analytical thinking, and knowledge of costing principles.

Certifications and Career Path

Professional credentials that enhance expertise in cost accounting include:

CIMA (Chartered Institute of Management Accountants)

ACCA (Association of Chartered Certified Accountants)

CMA (Certified Management Accountant)

Career roles include:

Cost Accountant

Management Accountant

Budget Analyst

Financial Controller

Operations Analyst

Real-World Example

Let’s say a bakery wants to introduce a new product—gluten-free muffins. Cost accounting helps:

Determine the cost of ingredients, labour, and packaging.

Allocate overheads like electricity and rent.

Set a selling price that covers costs and delivers a profit.

Analyse if the product will be more or less profitable than existing offerings.

Without cost accounting, pricing decisions would be guesswork, potentially hurting profits.

Conclusion

Cost accounting is more than just a financial function—it’s a strategic tool for managing efficiency, setting competitive prices, and improving overall profitability. By understanding and controlling costs, businesses can stay agile, resilient, and ready for growth.

If you’re looking to enhance your business operations or pursue a career in accounting, building your knowledge of cost accounting is an essential step.

Other Related Reading

What Is Accounting? A Beginner’s Guide to Financial Basics

What is Bookkeeping? A Complete Beginner’s Guide

What is Financial Accounting? A Clear Guide for Beginners

What is Managerial Accounting? A Practical Guide for Business Decision-Making

What is Tax Accounting? A Practical Guide for Businesses and Individuals

What is Tax Accounting? A Guide to Managing Taxes Effectively

What is Public Accounting? Services, Roles, and Career Insights

What is Private (Corporate) Accounting? A Guide for Businesses and Aspiring Accountants