In the world of business, where numbers tell a story, financial accounting plays the role of narrator. It organises, summarises, and reports a company’s financial performance for the benefit of internal and external stakeholders. Whether you’re a business owner, student, or someone interested in understanding financial health, learning about financial accounting is a vital first step.

Table of Contents

Defining Financial Accounting

Financial accounting is a branch of accounting focused on recording, summarising, and reporting the financial transactions of a business over a specific period. Its goal is to provide a clear and consistent picture of an organisation’s financial status, primarily through formal financial statements.

These reports are used by people outside the organisation—such as investors, creditors, regulators, and tax authorities—to make informed decisions about the business.

Key Objectives of Financial Accounting

- Transparency – Provide accurate and verifiable information to stakeholders.

- Standardisation – Follow accepted accounting standards for consistency across businesses and industries.

- Accountability – Hold companies accountable for how they manage and report their finances.

- Decision-Making – Help stakeholders assess the financial health and profitability of a business.

Core Financial Statements

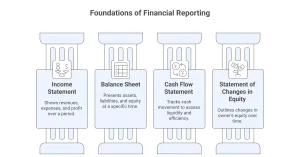

Financial accounting centres around the preparation of four key financial statements:

1. Income Statement

Also known as the profit and loss statement, this shows a company’s revenues, expenses, and profit over a set period. It answers the question: Is the business making money?

2. Balance Sheet

This snapshot of financial position includes assets, liabilities, and equity at a specific point in time. It shows what the company owns and owes.

3. Cash Flow Statement

This tracks the movement of cash into and out of the business, helping assess liquidity and operational efficiency.

4. Statement of Changes in Equity

This outlines changes in the owner’s equity over time, including profits retained in the business and any dividends paid out.

Principles of Financial Accounting

Financial accounting is governed by strict principles to ensure accuracy and comparability. These principles form part of larger frameworks such as Generally Accepted Accounting Principles (GAAP) or International Financial Reporting Standards (IFRS).

Key principles include:

- Accrual Principle: Revenues and expenses are recorded when they occur, not when cash is exchanged.

- Consistency: Companies must use the same accounting methods over time.

- Prudence (Conservatism): Accountants should anticipate losses but not profits.

- Going Concern: Assumes that a business will continue operating into the foreseeable future.

- Matching Principle: Expenses should be recorded in the same period as the revenues they help generate.

Who Uses Financial Accounting?

Investors

To evaluate the performance and stability of a business before investing.

Creditors and Lenders

To assess a company’s ability to repay loans.

Regulators

To ensure compliance with tax laws and financial regulations.

Management

While managerial accounting is more relevant internally, financial accounting offers essential insights for strategic planning.

Financial Accounting vs. Managerial Accounting

Though both deal with financial data, there are key differences between the two:

Feature | Financial Accounting | Managerial Accounting |

Users | External stakeholders | Internal managers |

Focus | Historical data | Future planning and decision-making |

Standards | GAAP or IFRS | No fixed standards |

Frequency | Usually quarterly or annually | As needed (often monthly or weekly) |

Reporting format | Formal, structured statements | Flexible reports for internal use |

The Financial Accounting Process

- Record Transactions

Every financial activity is recorded using journal entries. - Post to Ledger

Entries are transferred to individual accounts in the general ledger. - Prepare Trial Balance

A trial balance is created to ensure that credits equal debits. - Adjust Entries

Adjusting entries are made to reflect accruals or deferrals. - Generate Financial Statements

The final output is a complete set of financial reports.

Importance of Financial Accounting in Business

Legal Compliance

Businesses must report their financial performance to tax authorities and regulatory bodies.

Investor Confidence

Well-prepared financial reports attract potential investors and provide assurance to existing ones.

Access to Finance

Banks and financial institutions require financial statements before issuing loans.

Strategic Planning

Business leaders use historical data to make projections and set goals.

Technology in Financial Accounting

Modern financial accounting benefits significantly from digital tools and automation. Popular software like QuickBooks, Xero, SAP, and Oracle Financials streamlines the accounting process, reduces human error, and enhances real-time financial reporting.

Cloud-based platforms offer benefits like:

- Real-time data access

- Collaboration between teams and accountants

- Automated backups and security

Skills Required in Financial Accounting

Professionals in this field need:

Strong attention to detail

Analytical thinking

Understanding of financial standards

Proficiency with accounting software

Ethical judgement and integrity

Certifications and Career Paths

If you’re considering a career in financial accounting, recognised certifications include:

- ACCA (Association of Chartered Certified Accountants)

- CA (Chartered Accountant)

- CPA (Certified Public Accountant)

- CIMA (Chartered Institute of Management Accountants)

Career options range from corporate financial accountant to auditor, financial analyst, or finance manager.

Conclusion

Financial accounting is much more than a business requirement—it’s a strategic tool for understanding and communicating the financial story of an organisation. By adhering to established standards and providing reliable financial data, financial accounting builds confidence and drives smarter decisions for all stakeholders.

Whether you’re running a business, investing in one, or planning a career in finance, mastering the basics of financial accounting is a crucial step toward financial literacy and success.

Other Related Readings

What Is Accounting? A Beginner’s Guide to Financial Basics

What is Bookkeeping? A Complete Beginner’s Guide

What is Managerial Accounting? A Practical Guide for Business Decision-Making

What is Cost Accounting? Understanding Costs to Boost Profitability

What is Tax Accounting? A Practical Guide for Businesses and Individuals

What is Tax Accounting? A Guide to Managing Taxes Effectively

What is Public Accounting? Services, Roles, and Career Insights

What is Private (Corporate) Accounting? A Guide for Businesses and Aspiring Accountants