While financial accounting focuses on reporting past performance to external stakeholders, managerial accounting looks inward—helping managers and business owners make informed, strategic decisions. It’s a vital function in modern business operations, offering insights into costs, operations, and future planning.

If you want to understand how businesses make data-driven decisions or are considering a career in accounting or management, mastering the basics of managerial accounting is a valuable asset.

Table of Contents

What is Managerial Accounting?

Managerial accounting (also known as management accounting) is the practice of analysing and presenting financial data to help internal stakeholders—such as executives, managers, and department heads—make business decisions.

Unlike financial accounting, which is historical and externally focused, managerial accounting is forward-looking and used for internal purposes. It deals with budgeting, forecasting, cost analysis, and performance evaluation.

Purpose of Managerial Accounting

The primary goal of managerial accounting is to support internal decision-making. This includes:

- Setting budgets and forecasts

- Evaluating business performance

- Controlling operational costs

- Identifying inefficiencies

- Supporting strategic planning

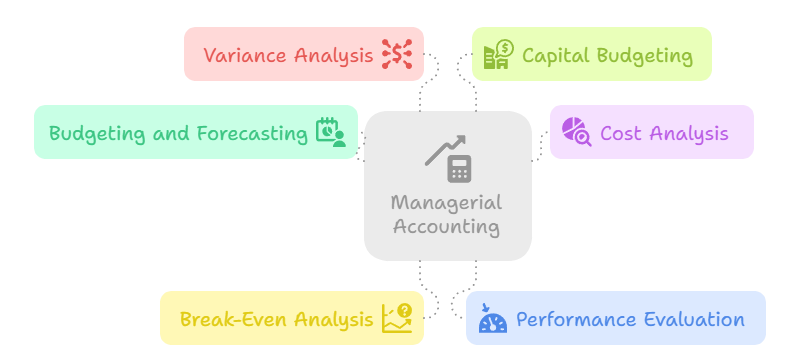

Key Functions of Managerial Accounting

Budgeting and Forecasting

Creating detailed financial plans for future periods based on historical data, business objectives, and market trends. This helps businesses allocate resources efficiently.

Cost Analysis

Analysing costs associated with products, services, or business processes to identify ways to reduce expenses and improve profitability.

Break-Even Analysis

Determining the point at which revenue equals costs, allowing businesses to understand how many units need to be sold to cover expenses.

Performance Evaluation

Using metrics and key performance indicators (KPIs) to assess the efficiency and effectiveness of departments, teams, or products.

Variance Analysis

Comparing actual financial outcomes with budgeted figures to explain deviations and guide corrective action.

Capital Budgeting

Evaluating long-term investments, such as purchasing new equipment or launching new products, to determine their profitability and risk.

Managerial Accounting vs Financial Accounting

While both fields use similar financial data, they serve different audiences and purposes:

| Feature | Managerial Accounting | Financial Accounting |

| Focus | Internal decision-making | External reporting |

| Time Orientation | Future-oriented | Historical |

| Frequency of Reporting | As needed (often monthly or weekly) | Usually quarterly or annually |

| Regulation | No mandatory standards | Follows GAAP or IFRS |

| Reporting Style | Flexible, tailored to management needs | Formal, standardised |

Types of Reports in Managerial Accounting

- Operating Budgets

- Cash Flow Projections

- Departmental Performance Reports

- Cost of Goods Manufactured (COGM) Reports

- Sales Forecasts

- Investment Appraisal Reports

These reports are customised and updated frequently to meet internal business needs.

Tools and Techniques in Managerial Accounting

Activity-Based Costing (ABC)

Allocates overhead costs more accurately by linking them to specific activities or processes.

Marginal Costing

Focuses on the cost of producing one additional unit, helping with pricing and production decisions.

Standard Costing

Assigns expected costs to products and compares them with actual costs to identify variances.

Ratio Analysis

Analyses financial ratios (e.g., gross margin, return on investment) to assess efficiency and performance.

Contribution Margin Analysis

Helps identify how products contribute to fixed costs and profitability.

Benefits of Managerial Accounting

- Better Decision-Making: Managers can act based on data, not guesswork.

- Cost Control: Helps identify where costs can be cut or optimised.

- Efficiency Improvements: Pinpoints areas of operational inefficiency.

- Strategic Planning: Supports long-term planning and investment decisions.

- Real-Time Insights: Enables proactive, rather than reactive, management.

Technology in Managerial Accounting

With the rise of digital tools, managerial accounting has become faster, smarter, and more accessible. Tools such as:

Microsoft Excel – Still widely used for custom financial modelling.

ERP Systems (e.g., SAP, Oracle) – Integrate data across departments for real-time decision-making.

Business Intelligence Tools (e.g., Power BI, Tableau) – Visualise trends and performance.

Cloud Accounting Software (e.g., Xero, QuickBooks) – Enables collaboration and on-demand reporting.

Skills Needed for Managerial Accounting

To excel in this field, professionals should have:

Analytical thinking

Business and financial acumen

Knowledge of budgeting and forecasting

Proficiency in data analysis tools

Strong communication skills to present data clearly

Career Roles in Managerial Accounting

Those skilled in managerial accounting can pursue roles such as:

Management Accountant

Financial Analyst

Cost Accountant

Budget Analyst

Operations Analyst

Relevant certifications include:

CIMA (Chartered Institute of Management Accountants)

ACCA with a management accounting focus

CMA (Certified Management Accountant)

Conclusion

Managerial accounting empowers businesses to make informed, data-driven decisions. By focusing on the internal workings of an organisation—its costs, operations, and forecasts—it helps leaders allocate resources wisely and plan for the future.

If you’re running a business or looking to grow your career in accounting or finance, understanding managerial accounting is not just helpful—it’s essential.

Other Related Readings

What Is Accounting? A Beginner’s Guide to Financial Basics

What is Bookkeeping? A Complete Beginner’s Guide

What is Financial Accounting? A Clear Guide for Beginners

What is Managerial Accounting? A Practical Guide for Business Decision-Making

What is Cost Accounting? Understanding Costs to Boost Profitability

What is Tax Accounting? A Practical Guide for Businesses and Individuals

What is Tax Accounting? A Guide to Managing Taxes Effectively

What is Public Accounting? Services, Roles, and Career Insights

What is Private (Corporate) Accounting? A Guide for Businesses and Aspiring Accountants